Facts About Mileagewise - Reconstructing Mileage Logs Uncovered

Facts About Mileagewise - Reconstructing Mileage Logs Uncovered

Blog Article

Not known Details About Mileagewise - Reconstructing Mileage Logs

Table of Contents3 Easy Facts About Mileagewise - Reconstructing Mileage Logs ShownA Biased View of Mileagewise - Reconstructing Mileage LogsTop Guidelines Of Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Things To Know Before You BuyThe Mileagewise - Reconstructing Mileage Logs DiariesThe smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking AboutThe Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

Timeero's Quickest Range function suggests the quickest driving path to your staff members' destination. This attribute boosts productivity and contributes to set you back financial savings, making it a vital possession for companies with a mobile workforce. Timeero's Suggested Course attribute even more improves accountability and effectiveness. Workers can compare the recommended path with the real path taken.Such a strategy to reporting and compliance streamlines the often complicated task of handling mileage expenses. There are numerous advantages related to making use of Timeero to monitor gas mileage. Allow's take a look at a few of the application's most notable functions. With a trusted gas mileage monitoring device, like Timeero there is no demand to stress over unintentionally omitting a date or item of information on timesheets when tax time comes.

The Greatest Guide To Mileagewise - Reconstructing Mileage Logs

These extra verification actions will keep the IRS from having a reason to object your gas mileage documents. With exact gas mileage tracking modern technology, your workers do not have to make rough mileage price quotes or even worry concerning mileage expenditure monitoring.

For instance, if an employee drove 20,000 miles and 10,000 miles are business-related, you can create off 50% of all cars and truck costs. You will need to continue tracking gas mileage for job even if you're making use of the real expenditure approach. Keeping mileage documents is the only way to separate service and individual miles and supply the proof to the internal revenue service

Many mileage trackers allow you log your journeys by hand while calculating the distance and repayment quantities for you. Numerous also featured real-time journey monitoring - you require to begin the app at the beginning of your trip and quit it when you reach your last location. These apps log your begin and end addresses, and time stamps, along with the total range and repayment amount.

Some Known Facts About Mileagewise - Reconstructing Mileage Logs.

One of the inquiries that The INTERNAL REVENUE SERVICE states that vehicle expenditures can be thought about as an "normal and necessary" cost during working. This includes costs such as fuel, maintenance, insurance policy, and the automobile's devaluation. For these costs to be considered insurance deductible, the lorry must be utilized for business functions.

Our Mileagewise - Reconstructing Mileage Logs Statements

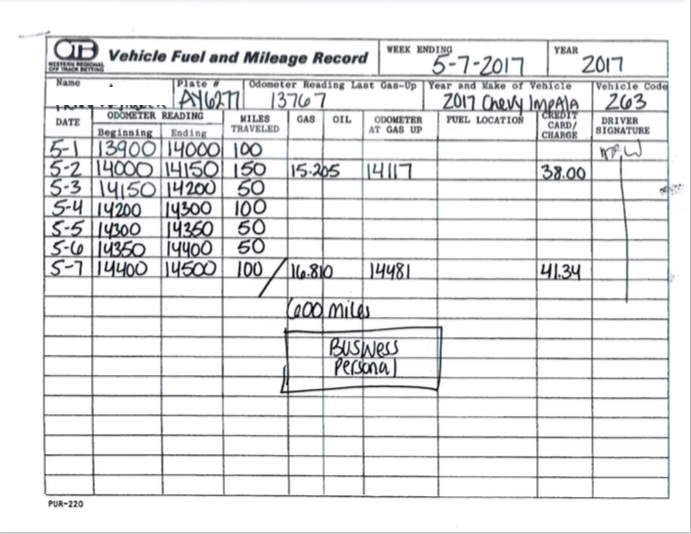

Beginning by taping your vehicle's odometer analysis on January first and after that once more at the end of the year. In in between, diligently track all your company journeys keeping in mind down the starting and ending analyses. For each and every trip, document the area and service objective. This can be streamlined by maintaining a driving log in your cars and truck.

This includes the total company mileage and overall mileage build-up for the year (business + personal), journey's day, destination, and objective. It's vital to videotape tasks without delay and preserve a coexisting driving log detailing day, miles driven, and service function. Below's how you can improve record-keeping for audit purposes: Begin with making certain a thorough gas mileage log for all business-related travel.

The Best Guide To Mileagewise - Reconstructing Mileage Logs

The actual expenses approach is an alternate to the typical mileage price method. As opposed to calculating your deduction based on an established price per mile, the actual expenses technique permits you to subtract the actual expenses linked with utilizing your car for company purposes - free mileage tracker app. These costs consist of gas, maintenance, repairs, insurance policy, devaluation, and other relevant expenses

Those with significant vehicle-related expenses or special conditions might benefit from the actual costs method. Please note electing S-corp status can change this computation. Inevitably, your chosen approach should straighten with your details financial goals and tax obligation circumstance. The Criterion Mileage Rate is a measure released each year by the internal revenue service to determine the insurance deductible expenses of running an auto for business.

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

(https://www.blogtalkradio.com/tessfagan90)Whenever you use your cars and truck for service trips, videotape the miles traveled. At the end of the year, once again write the odometer analysis. Compute your complete company miles by utilizing your start and end odometer analyses, and your videotaped business miles. Properly tracking your precise gas mileage for organization journeys aids in corroborating your tax obligation reduction, especially if you choose the Requirement Gas mileage method.

Tracking your mileage manually can need diligence, however remember, it might conserve you cash on your taxes. Adhere to these steps: Create down the day of each drive. Tape-record the overall gas mileage driven. Think about noting your odometer analyses before and after each trip. Write down the beginning and ending points for your trip.

Not known Facts About Mileagewise - Reconstructing Mileage Logs

In the 1980s, the airline market became the first industrial individuals of general practitioner. By the 2000s, the shipping market had embraced general practitioners to track bundles. And now nearly everybody uses general practitioners to obtain about. That means nearly click over here now everyone can be tracked as they go about their company. And there's snag.

Report this page